The Laffer Curve

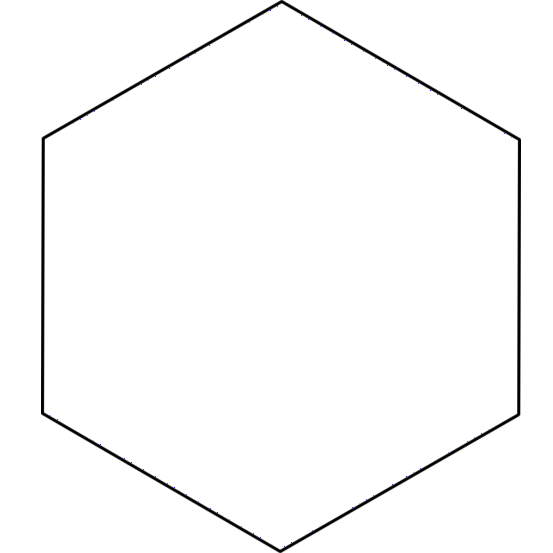

The horizontal axis here is level of taxation, and the vertical axis represents the amount of revenue the government takes in from taxpayers. On the left edge of the graph, the tax rate is 0%; in that case, by definition, the government gets no tax revenue. On the right, the tax rate is 100%; whatever income you have, whether from a business you run or a salary you’re paid, goes straight into Uncle Sam’s bag.

Which is empty. Because if the government vacuums up every cent of the wage you’re paid to show up and teach school, or sell hardware, or middle-manage, why bother doing it? Over on the right edge of the graph, people don’t work at all. Or, if they work, they do so in informal economic niches where the tax collector’s hand can’t reach. The government’s revenue is zero once again.

In the intermediate range in the middle of the curve, where the government charges us somewhere between none of our income and all of it—in other words, in the real world—the government does take in some amount of revenue.

That means the curve recording the relationship between tax rate and government revenue cannot be a straight line. If it were, revenue would be maximized at either the left or right edge of the graph; but it’s zero both places. If the current income tax is really close to zero, so that you’re on the left-hand side of the graph, then raising taxes increases the amount of money the government has available to fund services and programs, just as you might intuitively expect. But if the rate is close to 100%, raising taxes actually decreases government revenue. If you’re to the right of the Laffer peak, and you want to decrease the deficit without cutting spending, there’s a simple and politically peachy solution: lower the tax rate, and thereby increase the amount of taxes you take in. Which way you should go depends on where you are.

Notes:

Folksonomies: economics taxation

Taxonomies:

/law, govt and politics/government (0.683366)

/art and entertainment/movies and tv/movies (0.226989)

/business and industrial/company/earnings (0.184899)

Keywords:

tax rate (0.964767 (negative:-0.140105)), revenue (0.835980 (negative:-0.502694)), government (0.802782 (negative:-0.446227)), informal economic niches (0.745159 (negative:-0.293152)), politically peachy solution (0.732589 (positive:0.296959)), government revenue (0.718156 (negative:-0.318466)), right edge (0.715521 (positive:0.331492)), current income tax (0.707832 (negative:-0.432557)), tax revenue (0.687124 (negative:-0.547072)), Laffer Curve (0.621738 (negative:-0.254853)), horizontal axis (0.617400 (negative:-0.254853)), vertical axis (0.614240 (neutral:0.000000)), graph (0.596100 (positive:0.331492)), Uncle Sam (0.594982 (positive:0.256334)), left edge (0.593179 (neutral:0.000000)), intermediate range (0.581327 (neutral:0.000000)), it—in other words (0.580521 (negative:-0.520671)), straight line (0.575824 (neutral:0.000000)), tax collector (0.574600 (negative:-0.293152)), Laffer peak (0.566748 (positive:0.206751)), taxes (0.515053 (negative:-0.318466)), taxpayers (0.449191 (neutral:0.000000)), cent (0.443190 (negative:-0.202379)), wage (0.441292 (negative:-0.202379)), zero (0.441233 (negative:-0.432557)), case (0.439924 (neutral:0.000000)), salary (0.439735 (positive:0.309483)), spending (0.439264 (negative:-0.289496)), taxation (0.438507 (negative:-0.254853)), business (0.437347 (positive:0.309483))

Entities:

tax revenue:FieldTerminology (0.933602 (negative:-0.594809)), income tax:FieldTerminology (0.301555 (negative:-0.432557)), Laffer peak:GeographicFeature (0.200489 (positive:0.206751)), Uncle Sam:FieldTerminology (0.192449 (positive:0.256334)), 100%:Quantity (0.192449 (neutral:0.000000)), 0%:Quantity (0.192449 (neutral:0.000000))

Concepts:

Tax (0.983079): dbpedia | freebase | opencyc

Progressive tax (0.826359): dbpedia | freebase

Analytic geometry (0.696073): dbpedia | freebase

Taxation (0.678453): dbpedia

Income tax (0.670915): dbpedia | freebase | opencyc

Tax refund (0.637329): dbpedia | freebase

Taxation in the United States (0.596009): dbpedia | freebase

Public finance (0.584177): dbpedia | freebase